Some thoughts on XP Factory ($XPF.L)

Dear fellow investors,

as a long time passed since my last write-up and - inspired by

- I want to give you a short update on XP - Factory and some thoughts on the probably most pressing concerns.Since the company’s last financial update for the 15 months ended 31 March 2024 the stock has fallen further.

While the current FCF-yield of 25% (FCF adjusted to 12 months) is not far off the fair FCF-multiple owner-operated bars/pubs/restaurants are used to trade at (owner-operated stores used to trade between 5x and 10x FCF in contrast to franchising where valuations are c. 2x higher), the yield is on the very high-end and does not reflect the strong growth prospects, good capital allocation and superior economics of XP Factory.

Let us just revisit the box economics (example Boom Battle Bar): A Boom Battle Bar costs around 1m to build, landlords provide generous grants of c. 0.4m so that the actual costs are around 0.6m. After 1-2 years, the bars deliver a pre-IFRS 16 EBITDA of around 0.25m to 0.3m. So the return on growth capex is around 45-50%. If you were to invest a dollar today and would get 50 cents back in 1 to 2 years time, why wouldn’t you go for it?

So let’s uncover the most pressing concerns around XP Factory I can think of.

There a no accounting profits, the business model is flawed.

As one can imagine, a chain operating local stores needs some overhead (Admin expenses). Let’s look at few examples.

For example, you need an HR department making sure that bars are properly staffed in the busy season.

You also need regional sales manager making sure that bars operate at their very best and clients are satisfied.

Last but not least, in order to coordinate new builds, fit-outs or maintain existing stores you need to invest in project coordinators and a lot more.

These are all fixed costs. So the only option to increase profitability is to grow the top-line and let the existing estate mature es quick as possible. And this is what the company is doing right now.

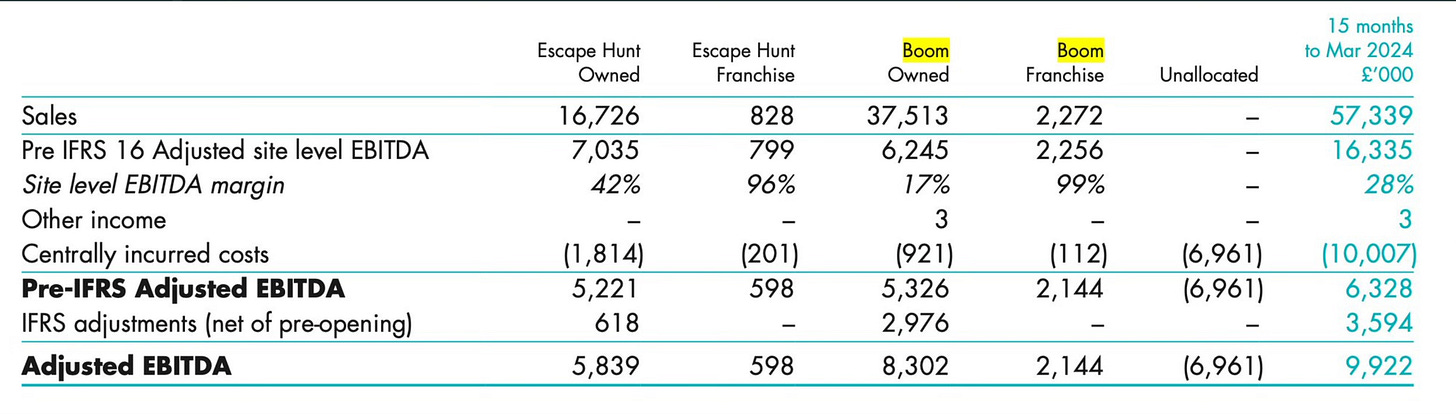

For example, if we add “Unallocated” + “Boom Owned” centrally incurred costs we land at ~21% admin costs which is a reasonable ratio in relation to sales. I found this ratio to be in line with privately owned Lane 7 from information I got from the company’s house database.

Other than that, IFRS-16 comes with some specifics in terms of lease accounting so that leases are basically front-loading the balance sheet in a very unfavourable way for growth companies so that interest expenses and D&A seem very high at the beginning while stores at the very beginning have little revenues and no profitability.

Graham Bird pointed out that under UK GAAP the company would have already posted a profit in FY24. As the company uses IFRS-16 accounting, a break-even is expected in FY25.

Meanwhile, the company has thrown off 6.5m free cash in the 15 months to March ‘24. As long as the company is not profitable on an accounting basis, it makes more sense to track cashflows.

They can’t keep up reinvesting at 40-45% ROCE.

Well, you could argue that - as competition for those spaces is heating up - there is no guarantee that those grants will continue forever. I agree with this perspective and also think it is likely that over time (unfortunately we don’t know when) this will ultimately happen.

Manchester remains the second largest market, but Birmingham has seen the fastest growth in CS over the past five years, with the city seeing a net influx of 14 operators – a 74% uptick in site openings and with more planned for the Bullring & Grand Central estates in 2024. Liverpool has seen a net increase of nine new operators, with five brands alone in Liverpool One shopping centre, including Junkyard Golf, Gravity Max, Escape Live, Roxy Ballroom and Esports venue, Level Tap, with Flight Club set to join the lineup in 2024. London has seen a smaller proportionate rise in openings at 6%, which is largely due to a lack of affordable opportunities with the right footprint rather than saturation.

However, even when eliminating grants, the return of new stores would be still around 25% to 30%. And a valuation at 5 x FCF is still low for such (still very good) economics.

Yet, research about competitors like Lane 7 let’s me believe that grants will continue for quite some time. The reason is that post-Covid shopping centres are changing. If you do some research about the hospitality and leisure industry there is a huge turmoil in the market.

And tenants like XP Factory are seen as the new anchor tenants, as they drive visitors. And visitors secure other shop’s rents under the same roof. So there are good reasons why landlords of shopping centres provide such generous grants. You can read more about it here.

Like-For-Like sales have dropped to almost zero, these stores must be a fad.

Yes, LFL dropping from mid-teens (16% to 20%) to low single digits (1-2%) in the matter of a year has been disappointing. Yet, local store businesses have little in common with recurring software businesses.

First, as four walls have a limited capacity, it is impossible to increase LFL infinitely.

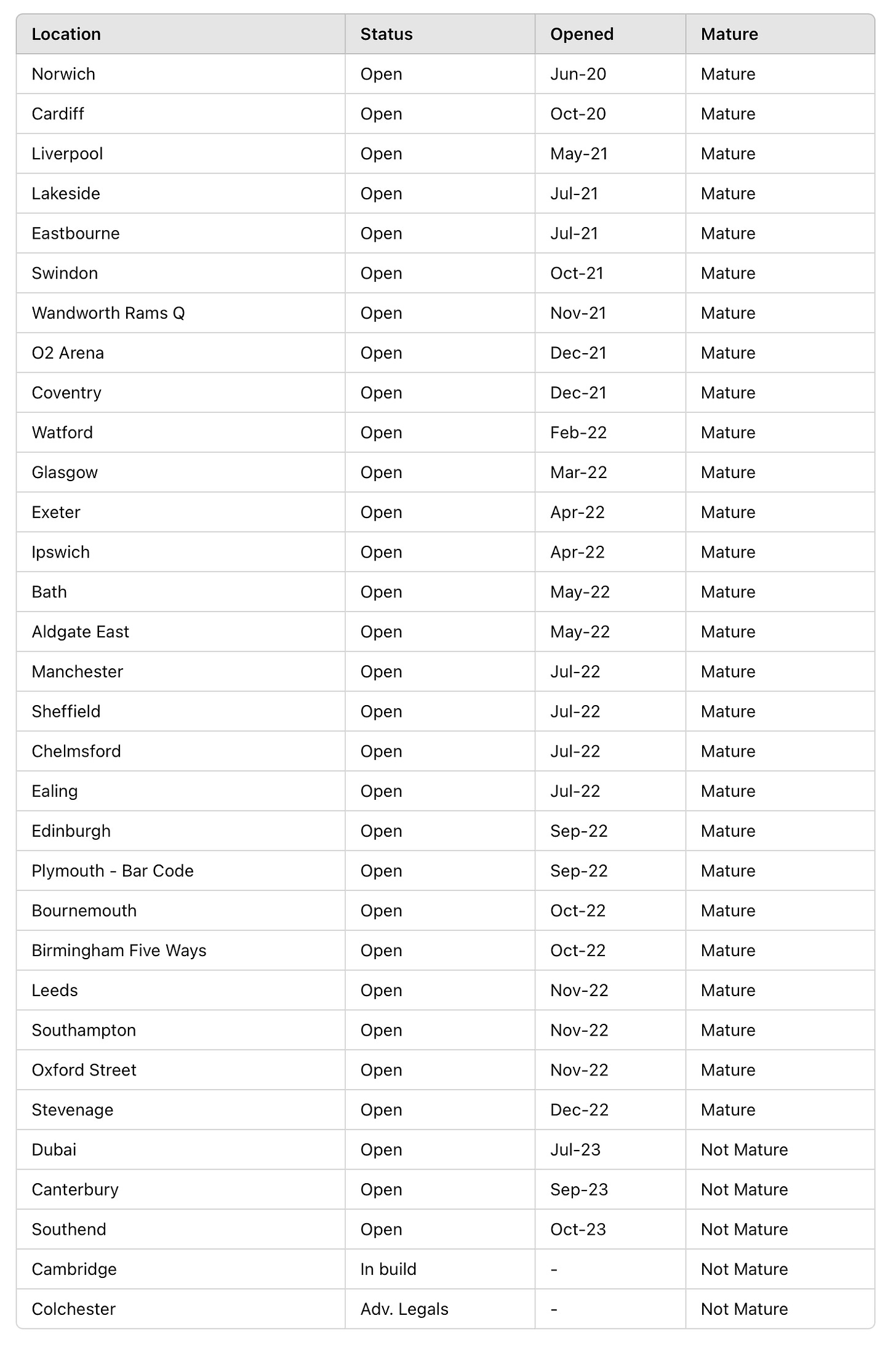

Secondly, LFL depends on the maturity of stores. Let’s check the current maturity profile for Boom Battle Bars. In the graphic below I assumed BBBs to be mature when being open for at least 1.5 years. So, as one can see, from 32 stores, only 5 are not yet mature. But it is those stores that are not mature, which drive LFL, because they start at zero sales. So how much can those 5 stores move the needle when you have 27 mature stores? The picture for Escape Hunt is similar so I leave it out here.

Third, you don’t need infinite LFL to make profits. While you need your capacity to be used and ideally to be maxed out, sales do not need to continuously increase on a store level to print a profit once you have covered your overheads. For sure I like increasing LFL and I also think organic growth will continue for some time although there will be some cyclicality.

This whole thing is a fad anyway

Whenever I am extremely bored I look at Google Maps Live Data to check the occupancy of stores (BBB and EH) randomly in the evening. While this is by no means an alternative measure of real figures published in financial reports, it gives me confidence in the traction of those venues.

While some stores underperform on a certain day, some stores smash it out of the park. Nothing really indicates that bars where you can play fun-games with your friends become obsolete anytime soon.

And as you can see at some times the stores are rarely visited and they still print cash. This is how bars work, they have a very uneven, cyclical visiting frequency.

They are empty until noon (closed anyway) and crowded only at peak times for several hours on only several days a week and not even in every season.

The best season is end of year, when people celebrate a lot and there is less frequency during summer vacations when people tend to spend their time outdoors. So whenever you see an empty bar, it is not necessarily a fad!

XP-Factory is a jellyfish fraud

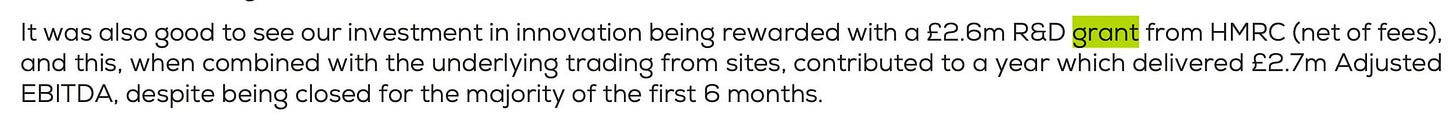

I saw some people freaking out about a 2.6m R&D grant the company pocketed in FY22.

Indeed, there was a company called Jellyfish supporting clients to claim R&D tax reliefs (more on this here) as legislation is sometimes so vague and so mismanaged that it is easy money for firms who know how it works.

So it is no secret that hundreds if not thousands of firms have gotten tax reliefs for claims that grants have never been designed for. And so it has been for Covid and other topics. (And so it will probably go on forever in the history of humanity).

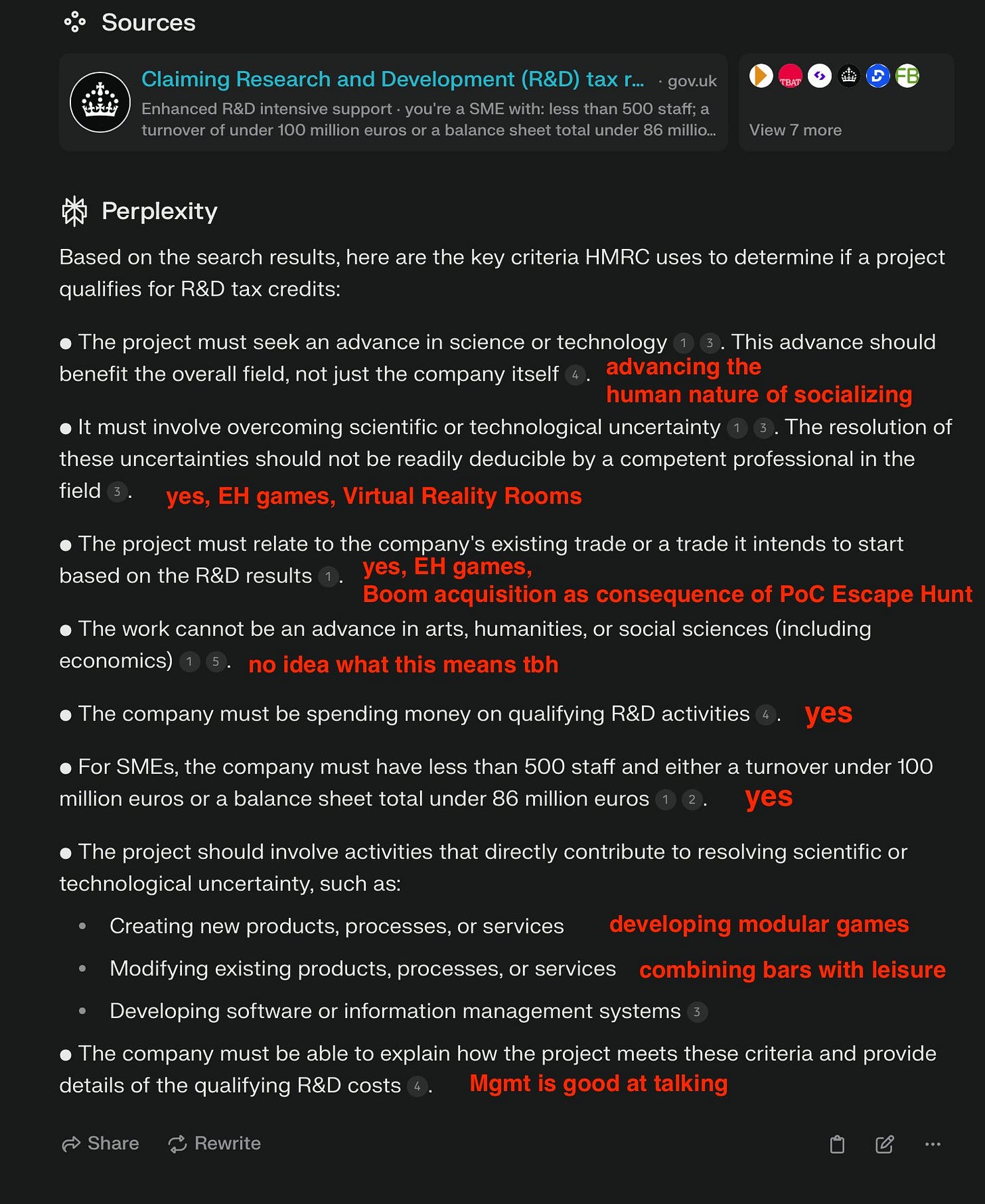

So I thought it would be funny to research the criteria for R&D grants and hand it in for XP Factory to demonstrate how easy it probably is to make R&D grants applicable to your business model. For sure I don’t know if HMRC would have accepted this but to be honest I wouldn’t be surprised if yes.

Hopefully my update finds you with a smile on your face and some further topics to dig into until we get the next financial update.

Until then you may read the recent FT-times article on competitive socialising. Or you may watch this company seminar hosted by ShareSoc. You could also read this excellent research note by Savills on competitive socialising in general.

what is the current situation with the company and its stock?